Rob’s comments are in italics

Derek’s comments are in normal font

Our topic today then is "stock" and "flow".

Right, this is a fundamental point. I sometimes worry whether I'm labouring the point in our broadcast series by stating the obvious. This concept will provide clarity to every aspect of what you examine once you're clear on it.

A stock is the measurement of any quantity. We think immediately of stocks in retail terms - your stocks are the goods you've got on hand ready to sell. For manufacturers, stocks are the raw materials available to start manufacturing.

In the broader sense, it's any static measurable quantity. Your stock of money is the total cash lying around plus the contents of your various bank accounts. With a large water system, it's the number of gallons or litres in the tank.

The flow is the rate at which that stock increases or decreases. Taking that water tank example, the flow measures litres per minute, second or week being extracted or filled up. Both activities might happen simultaneously.

For retailers, stock means the total items available for resale. For manufacturers, it's the total raw materials ready for production.

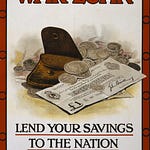

I want to examine this more broadly. We could discuss the stock of money you own - the total of your cash, bank accounts, savings systems.

We've talked about this before on a macro level when we were talking about the profit and loss accounts and the balance sheet, for example.

Exactly. Consider a water tank - it's the number of gallons or litres of water inside. The flow measures the rate of increase or decrease in that stock.

Water might be drawn from the tank at specific litres per second while simultaneously being refilled. The net flow represents the difference between these rates.

The same applies elsewhere. With shop goods, you monitor corn flakes packets sold daily versus deliveries. The difference affects stock levels.

Regarding cash flow, expenditure represents money spent per day, week or month. The inflow comparison determines whether stock levels rise or fall.

This becomes particularly relevant when examining economic health through gross domestic product or gross national product. These flow measurements don't reflect total country wealth.

Sounds like that's eerily relevant to today's world.

Though simple, this idea deserves consideration whenever statistics appear. Question whether it's a stock or flow. Consider what we wish to optimise as a reasonable proxy for measuring well-being.

I was thinking of Carol Dweck's book, The Growth Mindset. She argues your mindset on any issue is either fixed, as in I am good at finances or bad at finances. Or it's a growth mindset where you might be bad at finances, but on an upward trajectory.

Right.

Maybe that's the same thing, maybe that's stock and flow of skills for instance or knowledge or something else.

Okay, so a brief, brief episode this week, but I think as I say, that's an important point to take on board and to really internalise.

Thanks for reading this episode of Sovereign Finance. For more episodes, transcripts, in-depth articles, and the community, please take a minute now to subscribe free using the button above. You’ll receive a free email notification whenever we publish a new article or conversation.

Share this post