A quick announcement: We’re holding a free live Sovereign Finance discussion on Sunday 20th July, at 7.30PM on Zoom. We’ll discuss global trends, things you might do, and answer questions from the podcast so far. Register for free here.

Rob’s comments below are in italics.

Derek’s comments below are in normal font.

Our topic today is the BRICS annual conference, which started a few days ago. We've seen several trends accelerating that we've been discussing for a while. So we thought we'd talk about those today. Where do we need to start?

As you are aware, it was originally a group of five nations: Brazil, India, Russia, China, and South Africa. Now, the main hitters there are Russia and China. Brazil has the presidency of BRICS this year, and that's where the summit has been held.

They've now got up to 15 members. Iran has just become a full member, which is highly significant given the conflict with Israel and the United States. In addition to the 15 members, they've another dozen or so associate members.

This now represents approximately half the world's population and a substantial portion of the global industrial and economic activity. There has been an accelerating process of arranging international payments between them and establishing a system that's entirely independent of the American banking system, the SWIFT international money transfer system, and the dollar-based trading mechanisms.

It's been given an extra impetus by the attack on Iran. It's no secret that America is desperate and growing increasingly desperate to preserve its privileges of the dollar being the world reserve currency and one which has no anchor in linkage to gold, which was the way that it was originally set up in 1945. So this could all accelerate very rapidly. The dual processes of them trading with each other in a way which is independent of that system.

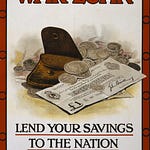

De-dollarization of the world currency system. It's very likely that, for a while now, it has been obvious that the currency system they introduce will almost certainly be ultimately anchored to gold in some way or another, whether they eventually move towards a single currency or not. If they're trading with one another, they've got to have some mechanism for confidence that the value of one country's currency is going to have some stability over at least the time that it takes to complete delivery and payment, which of course with floating currencies around the world, it is one thing that nobody could depend upon.

It sounds like we're witnessing the emergence of a multipolar world before our eyes.

Yeah, exactly. Once again, both Russia and China have been very forthright in laying out their vision of what a more equitable future world would look like. It would certainly be one where no single state has the imperial dominion over everybody else that for the last half a century or three quarters of a century the United States has had.

Do you think this heralds the potential end of the dollar?

Well, it's the beginning of the end of the dollar as the global reserve currency, I would say, as a matter of clear fact.

It sounds a bit like when the pound was the global reserve currency and now it’s an irrelevant footnote really to anyone outside of Britain.

When the pound was the de facto reserve currency, it was a gold-based currency. Each pound was, at that time, worth about a quarter of an ounce of gold.

It's debatable now whether we have much gold at all!

Well, yes, as we've mentioned in the past, it was a spectacular own goal for Gordon Brown to think it was a smart move to flog off about half of Britain's gold reserves to raise some quick cash shortly before the accelerating climb in the gold price.

So, the attack on Iran once again shifted the urgency, I would imagine, for that country to make its own independent arrangements.

They're going to need some powerful friends if they're going to get through the coming times.

Clearly they've been astonishingly lax in their own intelligence gathering and security to allow such a preemptive strike. It really, even if one takes at face value the ostensible reason for it, which was to prevent Iran from developing a nuclear weapon, which is hardly plausible anyway.

It's far more likely that it was an attempt to weaken that regime and replace it with one that would be more amenable to American and allied interests. From that point of view, it clearly had a spectacularly opposite effect. Rather than triggering a revolt against the current regime, it's had the effect of uniting the population entirely behind the present government.

That's what happened in the Second World War as well? Was it Germany that first started bombing civilian centres or did Britain bomb German civilian centres?

No, it was the German tactic, the blitzkrieg, the attack on particularly London and Coventry and the various industrial centres of Britain, which was fought off in the Battle of Britain. But it then set the standard, and the bombing of civilian centres has been a constant feature of warfare ever since.

In the ancient world, there was a convention of not attacking civilians. It wasn't really for humanitarian reasons. It was because the civilian population of the defeated nation would become enslaved. So you didn't want to kill your potential future slaves!

Nonetheless, it was a convention right up until the point where Franco, with support from Mussolini and Hitler, bombed Guernica, which horrified the world. Yet, less than 10 years later, this had become standard practice on all sides of the conflict.

But the point is it never demoralises the civilian population. It tends to cause people to rally around the cause instead.

Yeah. Of course, there could not possibly have been any expectation of the effectiveness of Iran's response from a military point of view. I'm not clear whether the ceasefire that Trump declared after the 12 days of conflict has been universally observed. Israel's record of honouring ceasefire arrangements speaks for itself. Anyway, one result of that has been a much strengthening of whatever arrangements Russia and Iran had for universal support on the military front. Another factor is that within the country, there was a significant body of opinion that advocated for greater rapprochement with the West.

An ending of the sanctions regimes and everything. This is now almost completely collapsed. They've presented one united front. Even the people who were, if you like, pro-Western have now concluded, well, we plainly can't trust them. So once again, that has been completely counterproductive. So this means that there is a considerable focus on building up the alternative arrangements with the rest of the world, which is not part of the American-led factions. So all of these are working together.

Trump's attempt to bully the rest of the nations by imposing tariffs on them has again been counterproductive. The attitude of China has been, well, if the Americans don't want to buy our goods, we'll sell them to other people.

They just come to other arrangements with more amenable trading partners.

Yeah. The other thing is that we don't generally in the Western world recognise the enormous success that China and India have had in getting large segments of their population out of poverty and into something resembling at least a lower middle-class standard of living.

Across China, India, and Southeast Asia, we've a population that is close to 50% of the entire world's population, of which approximately 90% were in poverty 20 years ago. This has now been reduced from 90 percent to getting pretty close to half and the process is continuing to accelerate because, once again, economics is not a zero-sum game. It's something which is self-reinforcing. The more prosperous people you have, the more they have to spend and the more they have to spend, the more they create prosperity for other people, which is the opposite of what's been happening in Britain, America, Europe, and the English-speaking world generally.

Especially when they're not required to spend it in dollars.

Yeah, exactly!

The majority of the population has seen their standard of living decline steadily since around 1975.

It's been an astonishing period to live through and to witness first-hand. The stories of the standard of living that was taken for granted across the British population when I was a child, a teenager, or a young adult seem completely fanciful compared with today. Almost nobody seems to be able to live within their income.

Not only that, but we also have a disintegrating infrastructure, including potholes in the roads. We have all the visible signs of decay and a tiny elite drawing more and more wealth towards themselves, which is then effectively being taken out of circulation. Not only that, you look at the civil engineering projects in China, the bridges, the tunnels, the dams. It's quite extraordinary.

There’s nothing like that happening here.

No, exactly. So, this is the thing to keep an eye on, to see the self-reinforcing changes take place.

There are 193 member states in the United Nations, but the decisions made by the United Nations are paralysed by the fact that the five permanent members of the Security Council, Britain, France, Russia, China and the United States, have a veto power. So they can prevent any significant alteration of the structure of the United States, and they can prevent any resolution being adopted that any one of them objects to. The United States has a solid record of vetoing proposals which have near-universal acceptance by the rest of the members. This is obviously a source of great frustration, and it renders the entire thing, whatever the ideals were, impotent.

Because eventually people will just leave and form alternative arrangements.

This is becoming increasingly clear day by day, and it is unavoidable to notice.

—

We are holding a Sovereign Finance live discussion on Sunday, 20th of July at 7.30PM UK time. To join us, register here.

Share this post