Introduction to Financial Statements

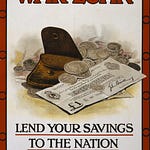

I think we need to look at the three basic forms of financial statements and what they mean for your business and you personally. Understanding these is essential when considering how to deploy your savings to build a nest egg for the future. This helps provide you with an income in later years and freedom from the necessity of working.

The Importance of Understanding Financial Statements

Accounting is generally a topic that many people don't feel enthusiastic about. I didn't either, and I've suffered from that both personally and as a business owner. People often find it arcane and complicated. However, it is crucial to understand these things. It's not rocket science, and there's nothing inherently complex about it. Unfortunately, our education system serves us poorly in this regard. A background understanding of how financial statements work should be part of everyone's education.

Types of Financial Statements

The three types of financial statements are the cash flow report, the profit and loss summary, and the balance sheet. Let's start with an important distinction between stock and flow.

Stock and Flow:

A stock is how much of something you have.

A flow is the rate at which that stock is increasing or decreasing.

For example, a supermarket might have a stock of cans of baked beans. The stock is the number of cans they have, while the flow is the number they purchase or sell over time.

Cash Flow Statement

The cash flow statement is a statement of the money coming in and going out, leaving you with a balance. Imagine someone working for a weekly wage in a cash economy. They get their wage packet at the end of the week, increasing their cash stock. As they spend money throughout the week, the stock decreases. The cash flow statement shows this process.

Profit and Loss Statement

The profit and loss statement is also a statement of flow and closely tied to cash flow, but with subtle differences. Most money going out for most people is an expense. Once it's spent, it's gone, like buying food or paying rent. Some purchases, like furniture or a washing machine, become assets. They may have reduced your cash holding, but they’ve been converted into a different type of asset. This brings us to the third type of financial statement: the balance sheet.

Balance Sheet

The balance sheet is where you add up all your assets and subtract your liabilities. This distinguishes it from the profit and loss account. For example, if someone spends all their cash by Wednesday or Thursday but still needs to buy groceries, they might have an arrangement with their local shop to take goods on credit, expecting to pay when their next paycheck arrives.

In the past, middle-class people often ran accounts at local department stores, buying clothes, furniture, and appliances on credit. These accounts were usually settled at the end of each month, although substantial purchases might be spread over several months.

Liabilities appear on the balance sheet too. When you add up all your assets, including any cash on hand, and subtract your liabilities, you're left with your net worth. If that’s negative, you’re technically bankrupt.

Application to Small Business

It's easy to see how this applies to a small business. The nature of the business determines the assets and liabilities. For a resale operation, assets include operational necessities and stock ready for sale. For a manufacturing business, assets include components for production and unsold finished goods. Liabilities might include credit accounts with suppliers, which must be paid off monthly, and accounts receivable from goods sold on credit.

The balance sheet is more like a snapshot at any given time because it doesn’t account for the direction of travel. My balance sheet as a service provider is actually very simple. I don’t have tremendous assets because I’m not reselling goods or similar items.

I (Rob) currently operate my business similarly to the credit line system you described. If a client is in good standing, I allow them to spread a large bill over three to six months. If they stop paying the monthly instalments, the services halt. This method, though it sounds archaic, is still prevalent, especially in B2B transactions.

Cash Flow Statements vs. Profit and Loss

The main distinction between money going out as an expense and acquiring an asset is critical. Expenses, like paying for car insurance or fuel, result in a negative impact on cash flow and profit. These expenses reduce the cash balance without adding any lasting value.

On the other hand, purchasing an asset, like new stock or a computer, doesn't reduce your profit by that amount because you acquire something of value. Paying off a supplier reduces your cash but also reduces your liabilities, thus not impacting the balance sheet by the amount of the cash spent.

If you obtain more stock from a supplier, your assets increase, but it hasn't impacted cash flow if you haven't paid for it yet. This transaction increases your assets and liabilities equally. This complexity goes beyond the simple calculation of money coming in, money going out, and the remaining cash balance.

Closing Thoughts

So, it’s worth pointing out that this applies to you as an individual if you’re trading as a sole trader, but it could also apply to your company if you're trading as a company.

In our next discussion, we’ll delve into investing and how to build an asset over a lifetime to support your pension fund. Understanding financial statements is essential for evaluating companies your pension fund might invest in. These principles help you decide where to invest and understand how fund managers manage your investments.

We’ve done a separate episode about why pensions often aren’t worth as much as you might think. However, pensions are still crucial for wealth management and accumulation.

Thanks for reading this episode of Sovereign Finance. For more episodes, transcripts, in-depth articles, and the community, please take a minute now to subscribe free using the button above. You’ll receive a free email notification whenever we publish a new article or conversation.

Share this post