(Key: Rob’s comments in italics, Derek’s comments in normal font)

Today we're going to cover an introduction to cryptocurrencies, which is a topic that I am excited to learn about. I think there's a lot of people in this boat, either they've dabbled with it or heard about it, or someone else has decided to invest lots of money in it. So, yeah, let's get into it.

The Problem Cryptocurrencies Address

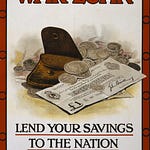

Okay, well, I think the best place to start is what problem cryptocurrencies are attempting to solve, and how well they address those problems. The starting point is that, as we've discussed before, the fiat currencies we use around the world—pounds, dollars, euros—have various drawbacks. The most extreme drawback is that they are constantly subject to inflation, or more bluntly, they are continually debased by the issuing of more and more currency by banks without doing anything for it. Another issue is the complexity and expense involved in exchanging different currencies.

So it's not a level playing field, in other words, is it?

It's not a level playing field. At its most basic level, money is an exchange of value, which ideally should be an honest exchange of work done by one person with work done by another. The problem with fiat currencies is that banks create new money, which can be seen as a form of counterfeiting. Cryptocurrencies, specifically bitcoin, aim to solve this by having a hard limit on the total number of coins that can be created, which helps prevent devaluation through over-issuance.

Bitcoin's Unique Features

I think what you can't argue with is that bitcoin appears to be like the 100-pound gorilla in the marketplace.

It absolutely is. One of its unique features is the hard limit of 21 million Bitcoins, set by its inherent mathematics. Over 19 million have already been mined. Bitcoin's transparency is another feature; the software to generate bitcoins and check transactions is open source. This means anyone with the relevant knowledge can verify the underlying algorithms and their implementation. Many experts have reviewed the code and confirmed its robustness.

The Mining Process and Transaction Verification

Bitcoin mining is akin to gold mining in that it requires effort and energy, which restricts the supply. Initially, mining bitcoins was easy and rewarded miners with 50 Bitcoins per block. This reward halves approximately every four years, reducing the rate at which new bitcoins are created. Now, most of the income for miners comes from transaction fees.

So the further back in the chain it is, the more kind of secure it becomes.

Exactly. Each block in the blockchain contains a compressed summary of thousands of transactions and is linked to the previous block, creating a continuous chain. This makes it extremely difficult to alter past transactions, ensuring the security and integrity of the blockchain.

Cryptography and Public Key Infrastructure

Cryptocurrencies use public key cryptography to secure transactions. Each Bitcoin owner has a private key, which they must keep secret, and a public key, which can be shared. Transactions are signed with the private key and verified with the public key. This method ensures that only the owner can authorize transactions, and the network can verify their authenticity.

Practical Uses and Future Potential

So let's maybe bring this back to the individual business owner who has maybe heard of this. It feels like there's not a huge amount of transactions going on in cryptocurrency.

Well, it's yet another currency. Bitcoin is one of the top ten most exchangeable currencies in the world, making it credible from a foreign exchange standpoint. While much of the currency exchange market is speculative, bitcoin could become significantly used for purchases. The first recorded Bitcoin transaction was in 2010 when someone paid 10,000 Bitcoins for two pizzas. Today, a single bitcoin is worth tens of thousands of dollars, making fractions of bitcoins (satoshis) more practical for everyday transactions.

Surely transacting would require, like, an Internet connection and a device, and there's various barriers there.

Yes, miners need significant computing power, but ordinary users only need a basic device with an Internet connection to send and receive bitcoins. There are also secondary layers like the Lightning Network, which aggregates small transactions to make the system more efficient and practical for everyday use.

Getting Started with Bitcoin

Would you recommend that someone listening maybe just goes through the process and buys 20 or 30 pounds of bitcoin, just to see how it works?

Yes, the best way to learn is to invest a small amount that you can afford to lose. The upside potential is considerable if Bitcoin becomes more widely used for transactions. Research wallet options and consider using one that isn't always connected to the Internet for added security.

I think this has been a good overview. If listeners have questions, there's plenty of different directions we could take this in terms of follow-up discussions. So, yeah, do leave a comment on the substack.

Thanks for reading this episode of Sovereign Finance. For more episodes, transcripts, in-depth articles, and the community, please take a minute now to subscribe free using the button above. You’ll receive a free email notification whenever we publish a new article or conversation.

Share this post