Rob’s comments in italic. Derek’s comments in normal font.

Debt in Modern Times

Debt is a major part of today's world, more so than in previous decades. This situation is an outcome of the global financial system's structure, particularly since the dollar came off the gold standard. The decoupling of the world currency system from any objective existence means that all money in circulation is essentially debt owed to someone. This is reflected in banknotes, which used to promise payment in gold but now only promise a nominal amount in currency.

The Nature of Money

Well, that's what it sort of said on the banknote, isn't it? It's like, I promise to pay the bearer the sum of whatever.

Yes, those statements are meaningless now. They used to say, "I promise to pay the bearer on demand the sum of one pound in gold." Even though from 1933 onwards, that wasn't literally true in Britain, it was still printed on the banknotes. Now they just say, "I promise to pay the bearer on demand the sum of 10 pounds or 20 pounds or five pounds," whatever it may be. What are they going to do? Give you another banknote in exchange?

So effectively, any money in existence is something which is owed to somebody else. The money brought into existence when a bank makes a loan goes into the borrower's account or to pay someone else, creating more reserves in the banking system. This allows banks to advance more loans based on reserve requirements. Increased money availability has led to inflation in housing costs and manipulation of interest rates. People become accustomed to paying larger amounts when rates rise, enabling them to bid higher on properties when rates drop.

Student Loans

Also, student loans in principle to invest in your future by paying for an education is arguably a sound thing to do. This of course assumes that you really are going to have a greater earning capacity in the marketplace if you get a university degree. And of course, there's a great many...

That makes sense if you're going to be a doctor, financier, or lawyer. It was very sneaky the way student loans were introduced. When I went to university, not only did we not have to borrow money, but unless your parents were very wealthy, grants covered your fees and living expenses. My father had to contribute a certain amount, but it was enough to live on for the academic year. When student loans were introduced, it was presented as a government scheme with nominal interest rates. Over time, these rates increased significantly, leading many to pay off loans over a lifetime.

The fees, the student fees have gone up a lot as well. Like even since when I first started, like I remember if I'd have got a year later, like the tuition fees would have been three times the amount. And I only did the three-year course. So if you're doing dentistry or something where you might be studying for six years...

Yes, and in the United States, doctors can accrue half a million dollars in debt by the time they qualify, making them effectively indentured servants to the medical industry.

It feels like a trap. It feels like that's kind of deliberate.

Good Debt and Bad Debt

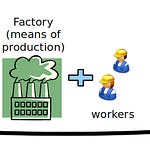

Yes. Is there any situation where this is not entirely pernicious? The title for today's talk was "Good Debt and Bad Debt." We defined capital as a specific type of wealth used to generate more wealth. In the context of small business, for example, a carpentry business requires workshop space, machinery, tools, a van, and initial stock. Different businesses have different capital requirements, but any enterprise needs some assets to operate.

Unless you have the money in savings, you need to acquire it from somewhere. You either get it from an investor who takes ownership of part of the business and a share of the profits, or you borrow it. Most small businesses borrow. For instance, a carpenter might need £20,000 to start. They evaluate their expected profit and how much they can repay while covering interest. This is a sound use of debt.

A business's financing can be examined in terms of debt versus ownership by shareholders and investors. If a business makes 20% profit annually on its capital, borrowing at a lower interest rate increases profitability. This principle, called gearing or leverage, can work both ways. In a bad year, interest payments on borrowed money can result in a net loss. Is that clear?

Yeah, that makes sense, yeah.

That's pretty much what I wanted to say on this topic for now. Is there anything that comes up for you out of what we've said so far?

I don't think, I think debt, so I think pretty much along the lines of what you said, I think debt can be a tool that you can use. Like this was why corporations were created in the first place was to achieve things that you wouldn't be able to personally finance. And you can still use that mechanism. But I think we want to be wary of, you know, a bit like with the student loan situation, getting caught in a sort of debt trap that means that you're probably never gonna clear those debts.

Historical Context of Debt

Yeah. In Daviud Graeber's book Debt: The First 5,000 Years, you'll find references to ancient practices where rulers periodically cancelled debts to keep society functioning. This wasn't out of benevolence but necessity. In the ancient world, primary capital was agricultural land. Smallholder farmers often went into debt and lost their land to more monopolistic holdings. This happened in America during the Great Depression, when small farmers who had borrowed to invest in machinery couldn't service their debts. Banks foreclosed on their properties, consolidating land ownership into the hands of a few large banks and corporate agricultural enterprises.

Land Ownership Today

Land ownership in the UK is also very consolidated, isn't it? I think in particular in Scotland, actually.

Yes. Landholding in the UK has a long history. When William the Conqueror arrived in 1066, he and his knights divided the country among themselves. Many landholdings today still belong to their descendants. Independent landowners are far fewer.

Very good. Okay, well, I think we'll leave this one here. And yeah, we'll speak to everyone next time.

Thanks for reading this episode of Sovereign Finance. For more episodes, transcripts, in-depth articles, and the community, please take a minute now to subscribe free using the button above. You’ll receive a free email notification whenever we publish a new article or conversation.

Good Debt and Bad Debt