(Key: Rob’s comments in italics, Derek’s comments in normal font)

Our topic today is capital and capitalism, which feels to me like a big hairy topic. So where do we need to start with this one?

Defining Wealth and Capital

Last week we were talking about wealth and what wealth is. I suggested that we should regard wealth as things that people want, value, and are prepared to trade for. Essentially, wealth is created by the activity of working on something that can then be traded for something else. This is broad, but there's a particular form of wealth called capital, which we'll unpick in more detail today.

We need to consider what capital means for investments, funding a pension, and from an entrepreneur's perspective. We also need to look at capitalism as a system, which many agree isn't working terribly well at the moment. We'll explore whether this is inherent in capitalism itself or just a reflection of the current form of capitalism.

Capital and Efficiency

I think it works very well in some regards. It works very well to increase efficiency. It works very well to get us producing lots of stuff. But there's no regard for the implications of all of that.

Yes, we'll be exploring those ideas. We'll round off by discussing whether capitalism or something else might lie in the future, and what might be possible for something that serves humanity and the planet better.

Perspectives on Capital

The word capital makes me think of two things. The first is a Charles Dickens novel with big factories and machinery operated by small children. The second is my business, where I have one share worth one pound on my balance sheet. These are two quite different things.

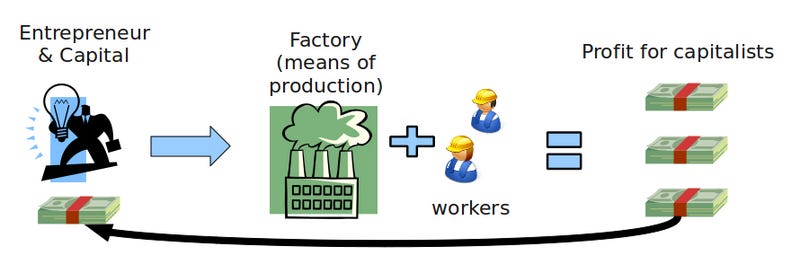

That's a good jumping-off point. There are two ways of thinking about capital. The most common is financial assets like stocks, shares, and bonds, part of a portfolio. But let's unpick what those shares and bonds represent. Essentially, the point of having these is to get a return on them, which will accumulate over time and eventually make you wealthy.

Historical Context of Pension Plans

I was just thinking about the difference between my dad's generation and mine. My dad worked for Unilever his entire working life and retired with a reasonable pension. That feels alien to me. I have one pension from an employer scheme and plan to take a tax-free lump sum at 55 and do something nice with it. So I need another way to fund my retirement.

That’s common. Forty years ago, the pension system worked convincingly for most people. People worked for good employers, contributed to a pension fund, and received an income in retirement, typically two-thirds of their final salary. However, changes in investment returns, inflation, and management fees have made it difficult for pension plans to deliver as expected today.

Investment and Returns

There’s a transaction fee every time money is invested in stocks and bonds within a pension fund, right?

Exactly. Fund managers pay stockbroker fees, draw management fees, and advisors get commissions. The entire first year's contributions often go to pay the advisor’s fee, significantly eroding returns.

Modern Pension Options and Advice

For the average 20 to 30-year-old, what would the advice then be? Is it worth having a pension?

For young individuals, the options are limited. It's vital to make realistic decisions about contributions. Self-invested personal pensions (SIPPs) allow for more control and potential tax advantages but require financial literacy.

Thanks for reading this episode of Sovereign Finance. For more episodes, transcripts, in-depth articles, and the community, please take a minute now to subscribe free using the button above. You’ll receive a free email notification whenever we publish a new article or conversation.

Capital and Capitalism